PHOENIX — Since the federal government shutdown began more than a month ago, there's been a lot of back and forth about the Affordable Care Act's enhanced premium tax credits that Democrats are fighting to keep in place.

Republicans have argued they cost too much and are supposed to sunset - but others worry about the consequences of them going away, specifically when it comes to how much premiums may go up.

According to KFF, a non-partisan, nonprofit healthcare research organization, the average person using the ACA marketplace could see their premiums rise by 114% next year if those enhanced premium tax credits disappear for good - meaning your costs would more than double.

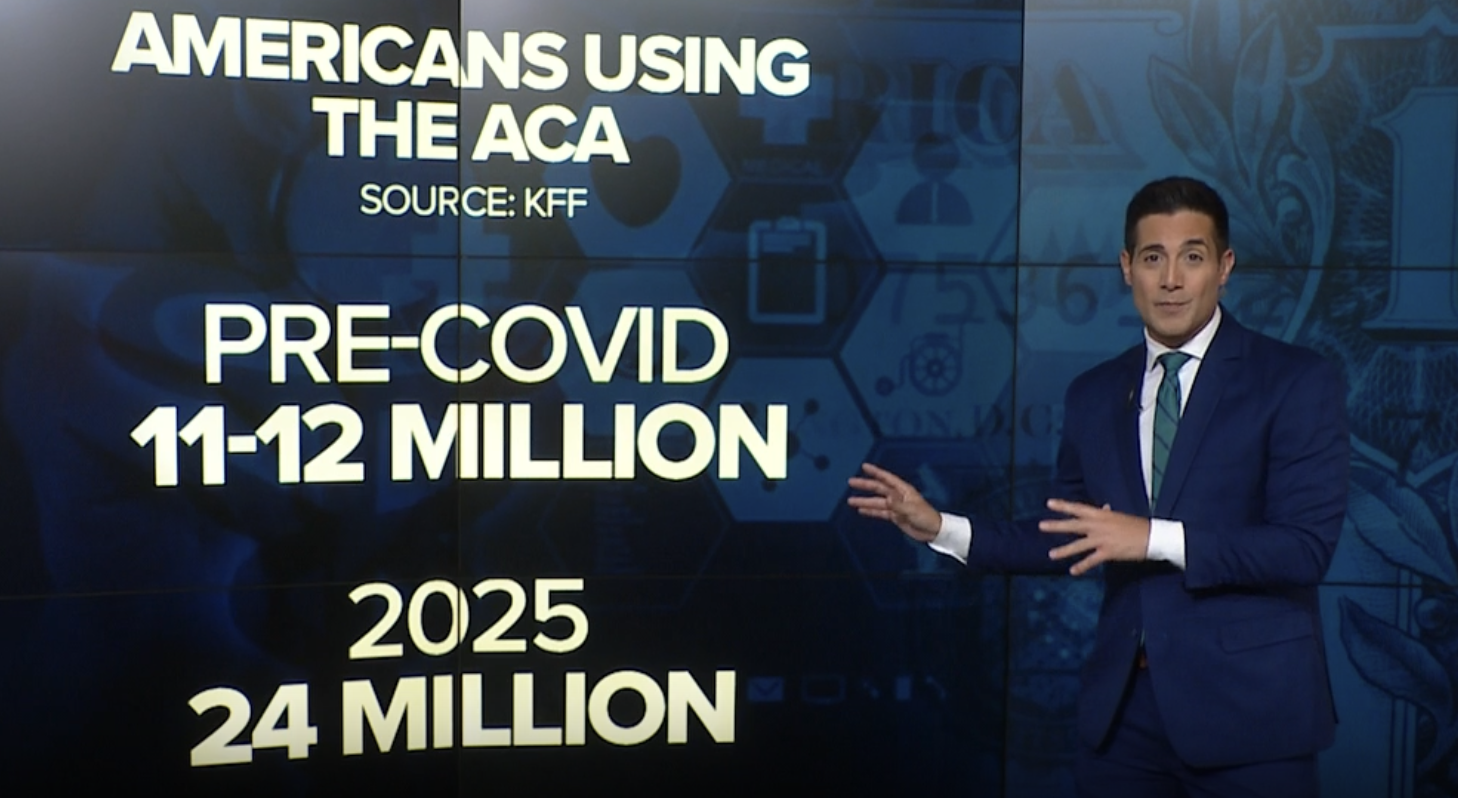

According to KFF, the enhanced subsidies have helped sign up more people onto the ACA.

Prior to the COVID-19 pandemic, there were about 11-12 million users on the ACA marketplace, but in 2025, that number had doubled to about 24 million.

In Arizona, back in 2019, there were about 160,000 people enrolled in health plans purchased on the ACA marketplace. By 2025, those numbers had soared to 423,000.

ABC15 spoke to Matt McGough, a policy analyst with KFF, who says an estimated four million people may need to leave their plans due to financial reasons if the enhanced tax credits go away, and he believes it would impact other health insurance markets and drive costs up overall.

"Including employer-sponsored plans," says McGough. "Which is how most people in the United States get health insurance coverage. That's because as more people become uninsured, it's likely that there is a medical emergency that when they go to the hospital, and under U.S. law they have to treat and stabilize them, that means there is some type of uncompensated care that is going on where the hospital has to foot the bill for some people, which drives up costs for everyone else because hospitals then have to charge higher prices to meet the uncompensated care they have to pay."