Think ghosts aren’t real? This one can make your money disappear. There’s a new “ghost tapping” scam. The Let ABC15 Know team shares how it works and how to protect your wallet.

Many of us like the ease of tap-to-pay — it’s fast, it’s convenient. But the Better Business Bureau is warning about a new scam that’s quietly draining bank accounts.

Scammers have found a way to turn that convenience into cash — for them.

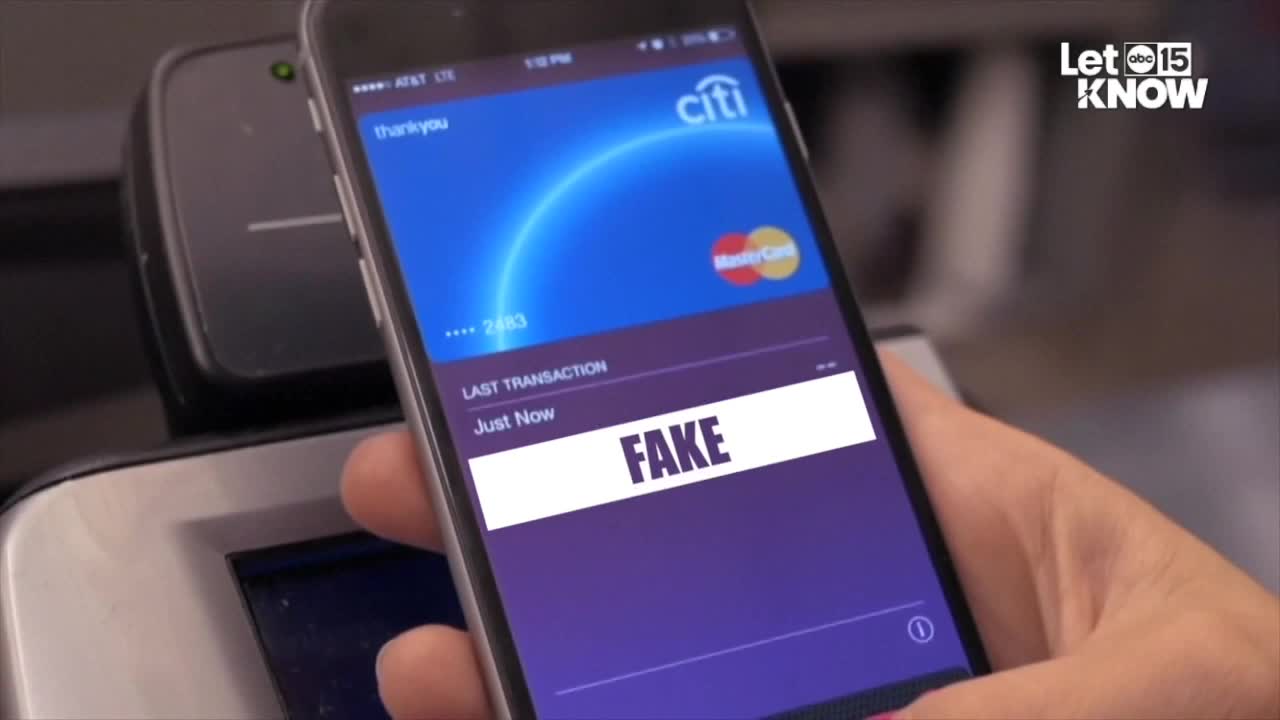

It’s called ghost tapping — and it happens when someone uses a wireless device to charge your tap-enabled card or phone… without you even knowing.

Unlike traditional card scams that require your card or PIN, this one can happen in a crowd… at a festival, or even in line at the store.

Scammers may pretend to be vendors… asking you to tap for a small purchase or donation — but what you’re really doing is approving a fake charge.

Here are the warning signs of ghost tapping:

- Look out for bank alerts about small or unusual “test charges”

- Watch out for a request to tap without showing you the total amount or offering a receipt

- Check for suspicious charges after you have been in crowded areas like festivals and markets

Here’s how you can protect yourself:

- Use RFID-blocking wallets or sleeves

- Double-check the merchant’s name and amount before tapping

- Turn on real-time alerts from your bank

- If you’re in a busy or high-risk area, skip the tap. Insert or swipe instead.

Ghost tapping — it’s not a trick…and if you fall for it, it’s certainly not a treat.