A long-awaited jobs report offered a mixed picture of the US labor market.

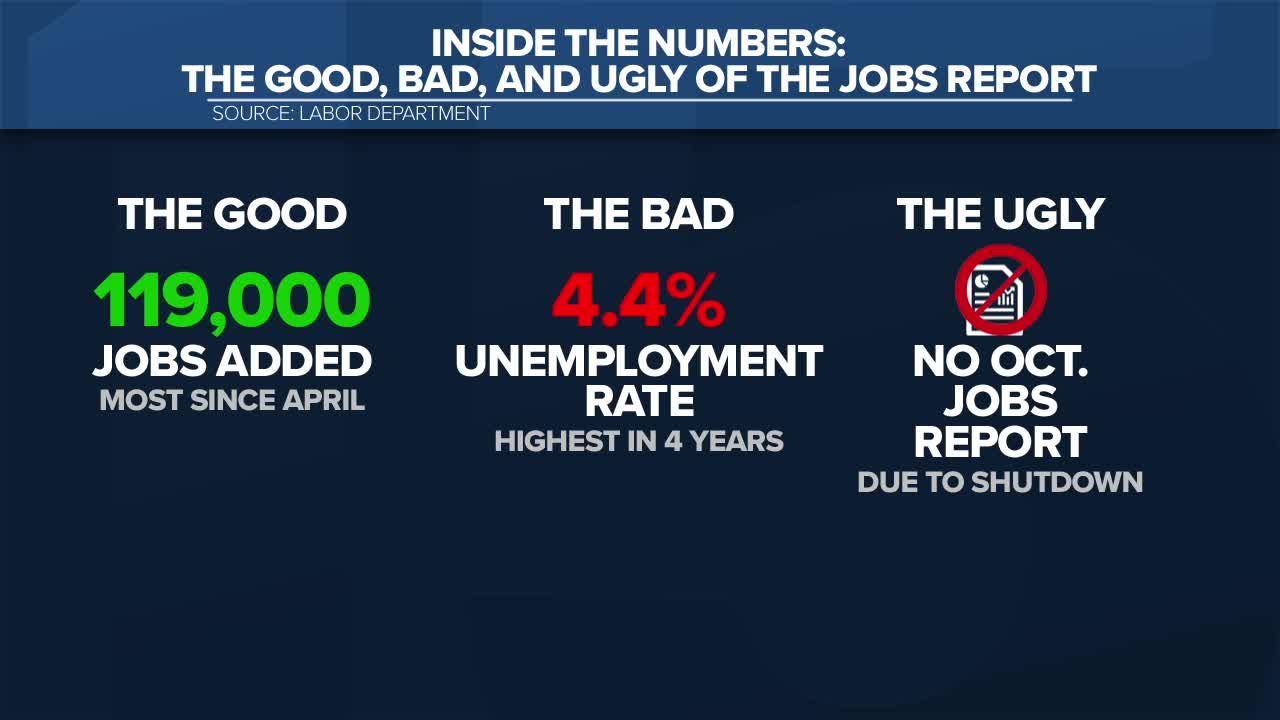

The economy added 119,000 jobs in September, an unexpected rebound for the labor market — but it comes as the overall economy shows signs of slowing.

Economists were expecting 50,000 jobs to have been added and an unemployment rate that remained at 4.3%, according to FactSet.

Delayed for seven weeks due to the government shutdown, the latest snapshot of America’s job market showed that unemployment rose in September to the highest level in nearly four years.

In addition, August’s tepid job gains of 22,000 were revised to a job loss of 4,000 jobs and July was revised down by 7,000 jobs, according to Bureau of Labor Statistics data released Thursday.

The health care and social assistance sector continued to drive overall employment growth. Those sectors added an estimated 57,100 jobs in September, accounting for nearly half of the overall gains. Leisure and hospitality contributed 47,000 jobs during a month with unseasonably warm weather.

Jobs were lost in sectors such as transportation and warehousing (-25,300), temporary help services (-15,900) and manufacturing (-6,000).

Although the September employment data has been on the shelf since early October, it provides a critical snapshot of the labor market at a time when tariffs, stubborn inflation and elevated interest rates continue to slow the US economy.

Summer of job losses

Plus, Thursday’s report might very well be the last clean jobs report for a couple of months, since the shutdown mucked up the finely tuned process of data collection and analysis during October and part of November. The BLS on Wednesday announced that there will not be a separate October jobs report published but instead some of that data will be included in the November report scheduled for December 16.

Despite the stronger-than-expected September gains, this year is still on pace for the weakest employment growth since the pandemic and, before that, the Great Financial Crisis.

“The job market was really weak in the summer, and it didn’t improve much in September,” said Heather Long, chief economist at Navy Credit Union. “What we learned today is that both June and August had negative job growth, so, shedding jobs; 119,000 is pretty good for September, but when you step back, the average (monthly job gain) of the past four months is in the low 40,000s.”

“So, it looks very weak,” she added.

Unemployment, a closely watched recession indicator, ticked higher in September, rising to the highest rate since October 2021.

However, driving the jobless rate higher was an increase in the labor force – primarily an uplift in more people looking for work, versus a sharp increase in layoffs, BLS data shows.

Low-fire, low-hire, low-opportunity market

The job gains remain heavily concentrated. Two sectors – health care and social assistance, and leisure and hospitality – accounted for 87% of September’s job growth.

But in a labor market that’s been in a low-hire, low-fire slog, there are also few opportunities for those seeking work. On average, it’s taking people six months to find work, according to the latest BLS data.

The latest unemployment claims data supports that trend: In a separate report on Thursday, the Labor Department reported that an estimated 1.974 million people filed continuing claims for unemployment insurance for the week ended November 8, hitting a fresh four-year high.

Initial claims, which are considered the best proxy for layoff activity, fell to 220,000 last week, remaining well below more concerning thresholds (300,000 to 400,000 range, consistently).

“If I had to characterize it, it still looks a lot like ‘no-hire, no-fire,’” Long said. “I do worry, given the number of industries that are starting to fire, that this is starting to look like ‘no-hire, start-to-fire.’”

‘Cold water’ for a Fed cut

Despite the mixed bag of data, the September report “could throw cold water” on the Federal Reserve cutting interest rates further when it meets in December, Kathy Bostjancic, chief economist at Nationwide, wrote in a note on Thursday.

“The sharp rebound in employment gains, up 119,000 in September following the downwardly revised negative 4,000 print in August soothes concerns that the labor market was on the precipice of a large downturn and removes urgency for another rate cut,” she wrote.

Still, because of the historic government shutdown, the September jobs report will be the freshest official monthly employment snapshot available when the Fed makes its next interest rate decision on December 10. The partial October and full November data won’t come out until the following week.